New Members: Be sure to confirm your email address by clicking on the link that was sent to your email inbox. You will not be able to post messages until you click that link.

counter trade entry scans - price in lower 20% of 10 day range

If you like short term trades, buying a pull back in an up trending stock is a reasonable strategy.

Here is a scan for finding stocks that have traded into the lowest 20% of their 10 day range. The most strongly trending stocks often won't do this that often. However, with a scan that casts a wide net, it's possible, at least in some markets to find opportunities often enough to make it worthwhile.

// 00 00 00 30 010 K10 xb 20 hits in STOCKS

// find K10 xb 20 hits in stocks only

[[exchange is NYSE] or [exchange is NASDAQ]]

and

[ // sectors open bracket

[[market cap > 100] and [group is EnergySector]] // comment out sectors that don't interest you

or [[market cap > 100] and [group is MaterialsSector]]

or [[market cap > 100] and [group is IndustrialSector]]

or [[market cap > 100] and [group is ConsumerDiscretionarySector]]

or [[market cap > 100] and [group is ConsumerStaplesSector]]

or [[market cap > 100] and [group is HealthCareSector]]

or [[market cap > 1000] and [group is FinancialSector]]

or [[market cap > 100] and [group is TechnologySector]]

or [[market cap > 100] and [group is CommunicationServicesSector]]

or [[market cap > 100] and [group is UtilitiesSector]]

or [[market cap > 100] and [group is RealEstateSector]]

] // sectors close bracket

and [symbol not contains '/'] // this avoids special issues

and [sma(21,volume) > 500000] // or your choice

and [close > 5] // or your choice

// and [close < 100] // or your choice; use one or both to limit hits to a price range that suits you

and [SCTR > 70] // or your choice; you do want good relative strength stocks

// K10 has been above 80 in past 2 weeks (price has shown some strength)

and [1 day ago max(10, Fast Stoch %K(10,1)) > 80]

// K10 has not bee below 20 in past 2 weeks (try to get first crossing)

and [1 day ago min(10, Fast Stoch %K(10,1)) > 20]

and

[

// close crossed into bottom 20% of yesterdays's ten day range

[20 x Fast Stoch %K(10,1)]

or

// low crossed into bottom 20 per cent of yesterday's ten day range

[1 day ago min(10,low) +[[1 day ago max(10, high)-[1 day ago min(10, low)]]*.2] x low]

]

rank by SCTR

Even with SCTR, not every hit will be great. You should probably prefer hits coming off a new trend high, and earlier in the trend.

Also, the entry should be AFTER a close above the MA 3 of HIGHS. Enter probably next day below that MA, with a stop below the 10 day lower price channel. If ranges are wide, pass on the hit.

Here's an example:

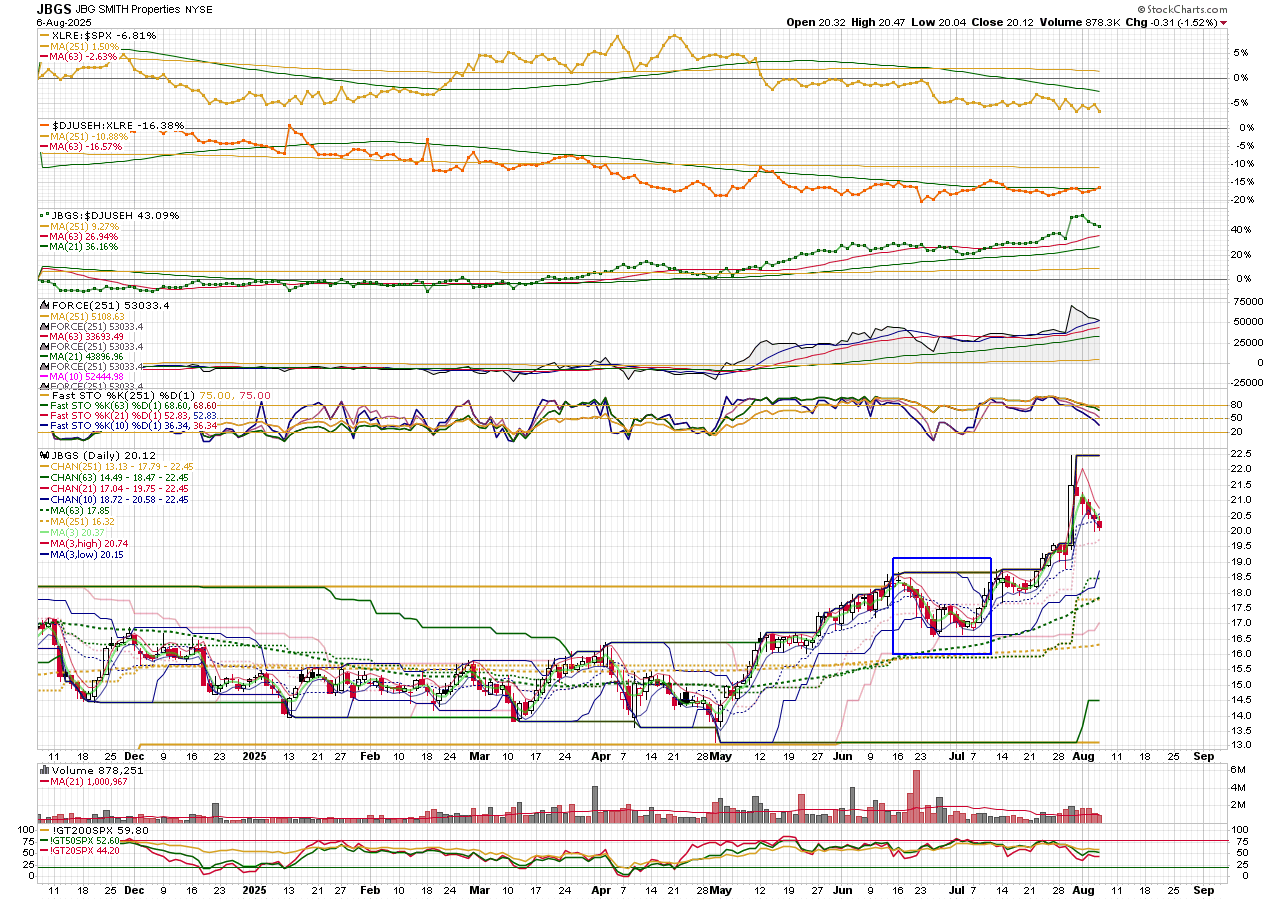

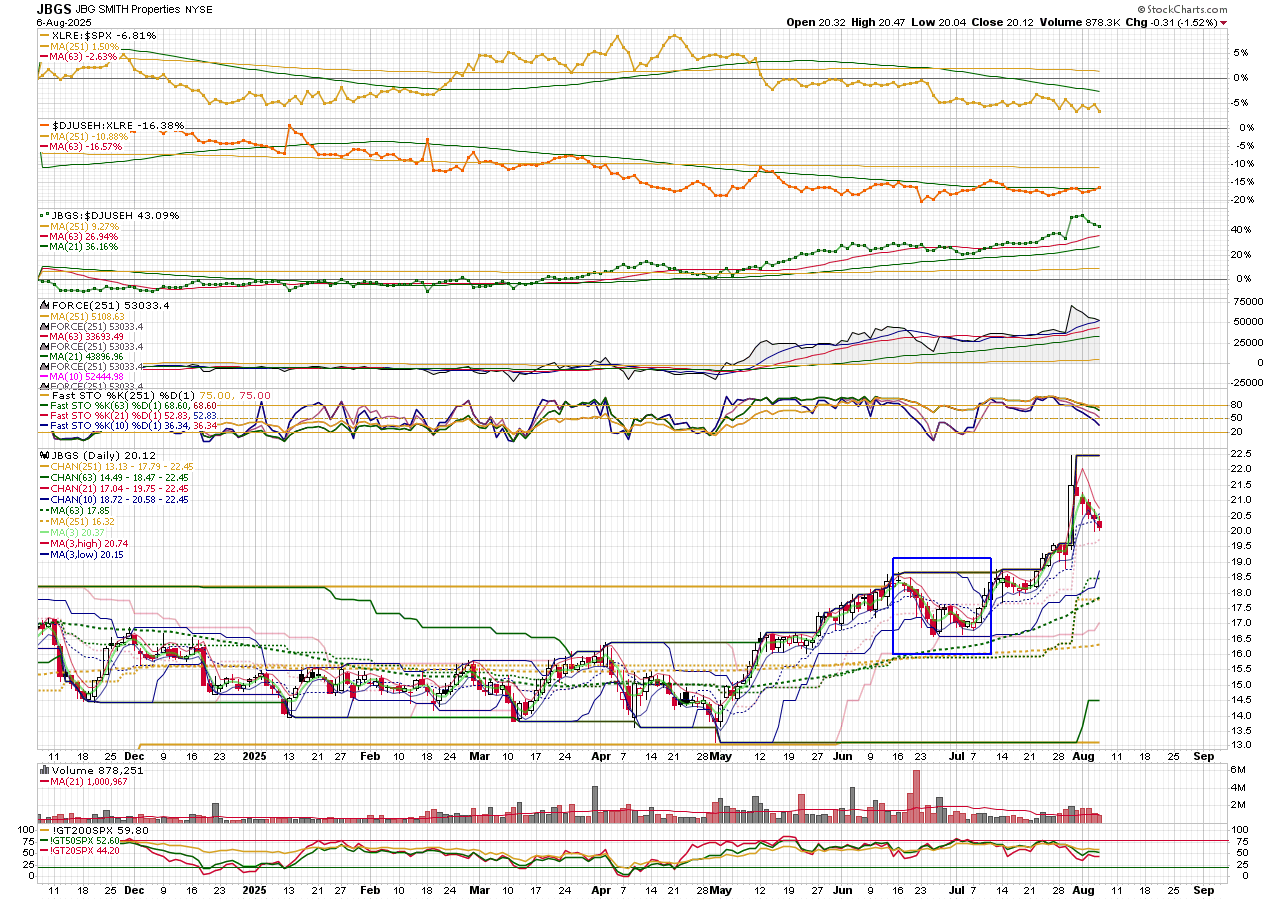

The first scan hit is June 20 (because the long tail gets into the Fast K10 bottom 20% range). Price continues down - so the hit itself is not the entry. Price stays below the MA 3 of highs on a closing basis until Jul 8. In this case price doesn't pull back into below the MA 3 of highs. JBGS is a good candidate because it has just broke out above its 63 day channel (green) after a long basing period, and this is the first pull back. Note the Fast K 20 also crossed below 20, which is another variation on this idea but more for mid-length trades.

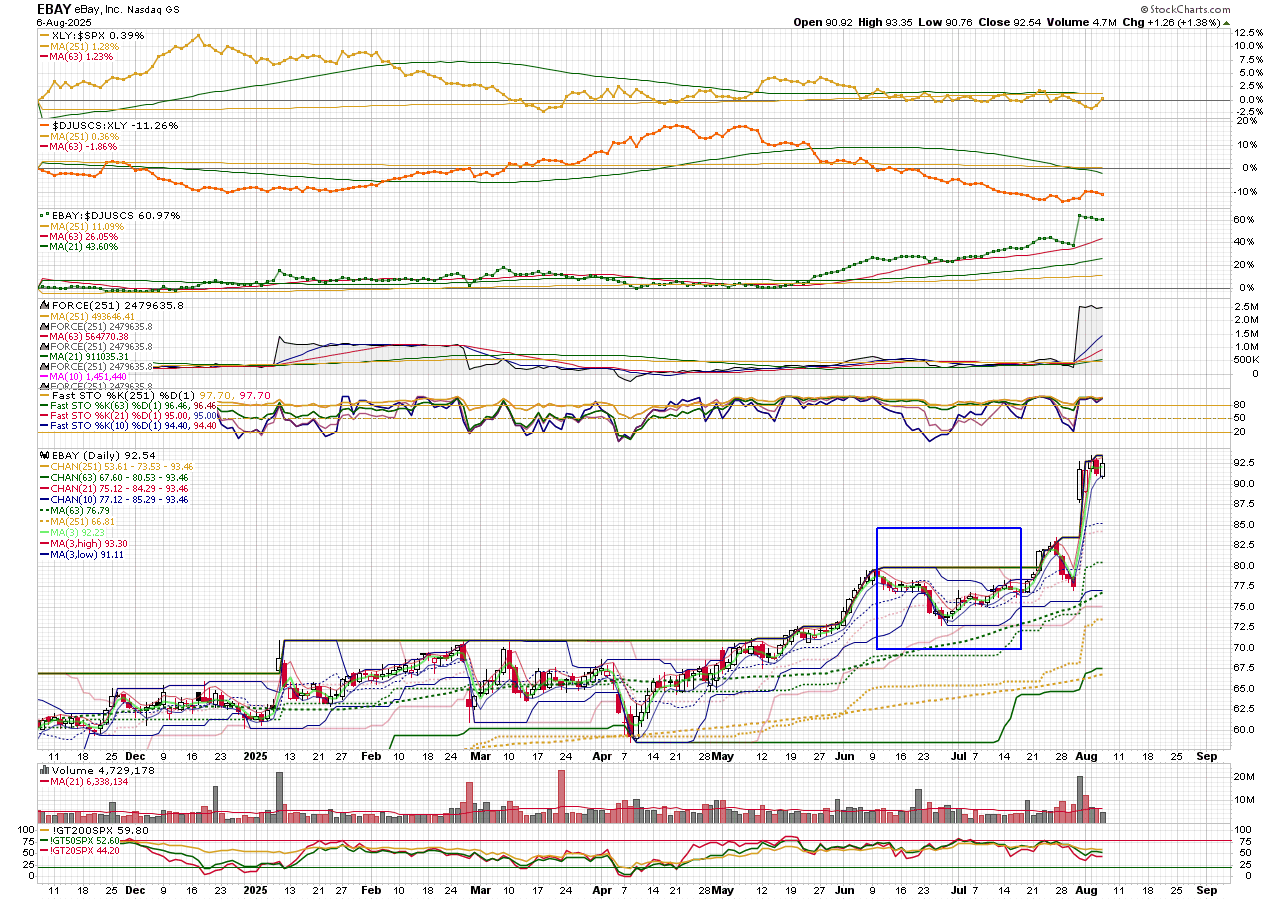

Here's another example, also scan date Jun 20.

Here again price continues down after the hit, closes above MA 3 Jul 1, then dips back below it, offering a chance to get in. This is also a good candidate because it follows a recent breakout above the 251 and 63 day upper channels and is not too far from a long basing period.

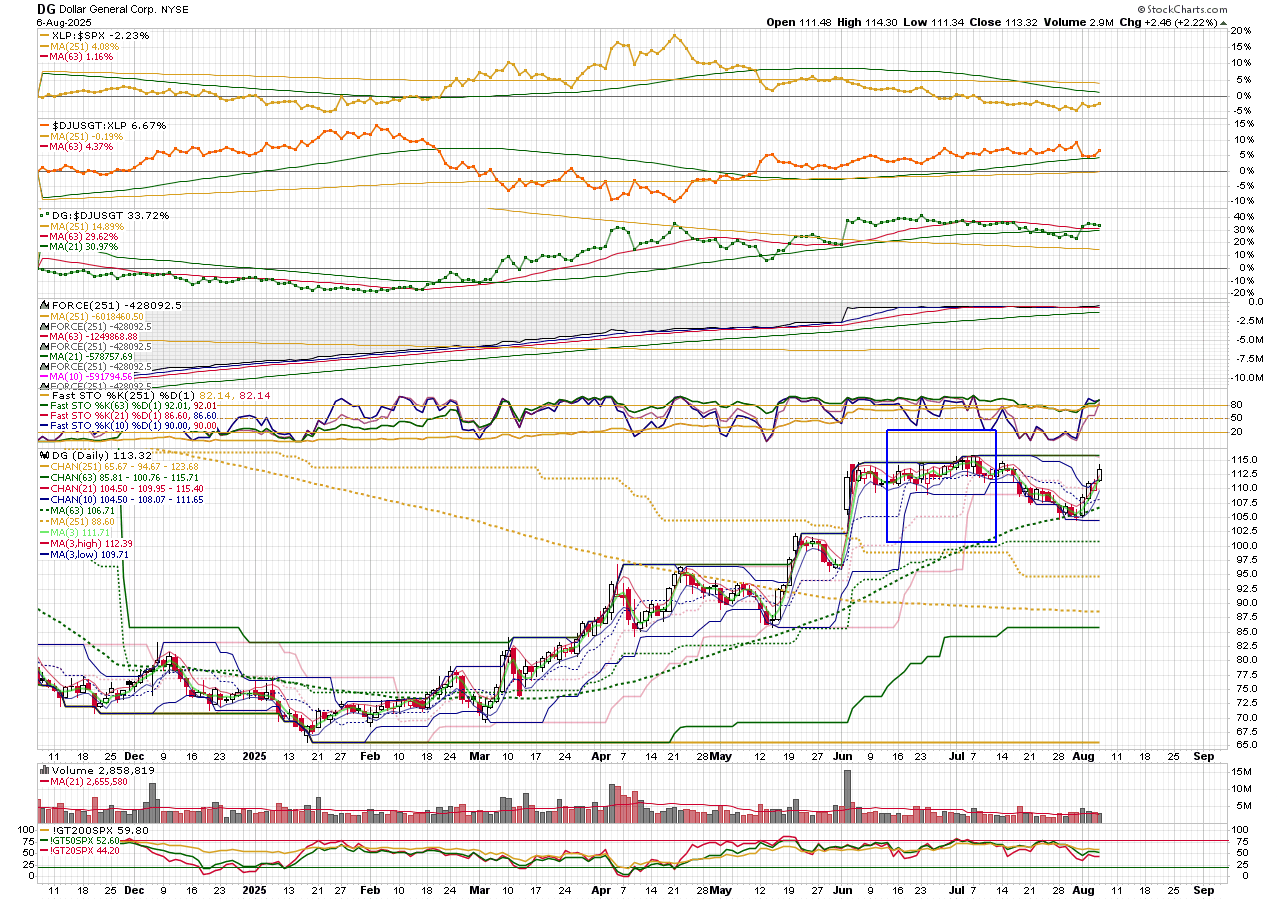

One more example:

This one doesn't work out, even though it fits all the scan criteria. The hit was the more the result of the ranging price - the channel comes up to meet price instead of price dropping to the channel. Also the big jump in price and volume in early Jun is an irregularity that interferes with the normal pattern.

p.s. specifying the sectors at the top of the scan excludes ETFs and other issues not belonging to a sector (some foreign issues, mutual funds, commodity and bond funds, etc.). I don't know if non-common stock issues respond similarly.

Here is a scan for finding stocks that have traded into the lowest 20% of their 10 day range. The most strongly trending stocks often won't do this that often. However, with a scan that casts a wide net, it's possible, at least in some markets to find opportunities often enough to make it worthwhile.

// 00 00 00 30 010 K10 xb 20 hits in STOCKS

// find K10 xb 20 hits in stocks only

[[exchange is NYSE] or [exchange is NASDAQ]]

and

[ // sectors open bracket

[[market cap > 100] and [group is EnergySector]] // comment out sectors that don't interest you

or [[market cap > 100] and [group is MaterialsSector]]

or [[market cap > 100] and [group is IndustrialSector]]

or [[market cap > 100] and [group is ConsumerDiscretionarySector]]

or [[market cap > 100] and [group is ConsumerStaplesSector]]

or [[market cap > 100] and [group is HealthCareSector]]

or [[market cap > 1000] and [group is FinancialSector]]

or [[market cap > 100] and [group is TechnologySector]]

or [[market cap > 100] and [group is CommunicationServicesSector]]

or [[market cap > 100] and [group is UtilitiesSector]]

or [[market cap > 100] and [group is RealEstateSector]]

] // sectors close bracket

and [symbol not contains '/'] // this avoids special issues

and [sma(21,volume) > 500000] // or your choice

and [close > 5] // or your choice

// and [close < 100] // or your choice; use one or both to limit hits to a price range that suits you

and [SCTR > 70] // or your choice; you do want good relative strength stocks

// K10 has been above 80 in past 2 weeks (price has shown some strength)

and [1 day ago max(10, Fast Stoch %K(10,1)) > 80]

// K10 has not bee below 20 in past 2 weeks (try to get first crossing)

and [1 day ago min(10, Fast Stoch %K(10,1)) > 20]

and

[

// close crossed into bottom 20% of yesterdays's ten day range

[20 x Fast Stoch %K(10,1)]

or

// low crossed into bottom 20 per cent of yesterday's ten day range

[1 day ago min(10,low) +[[1 day ago max(10, high)-[1 day ago min(10, low)]]*.2] x low]

]

rank by SCTR

Even with SCTR, not every hit will be great. You should probably prefer hits coming off a new trend high, and earlier in the trend.

Also, the entry should be AFTER a close above the MA 3 of HIGHS. Enter probably next day below that MA, with a stop below the 10 day lower price channel. If ranges are wide, pass on the hit.

Here's an example:

The first scan hit is June 20 (because the long tail gets into the Fast K10 bottom 20% range). Price continues down - so the hit itself is not the entry. Price stays below the MA 3 of highs on a closing basis until Jul 8. In this case price doesn't pull back into below the MA 3 of highs. JBGS is a good candidate because it has just broke out above its 63 day channel (green) after a long basing period, and this is the first pull back. Note the Fast K 20 also crossed below 20, which is another variation on this idea but more for mid-length trades.

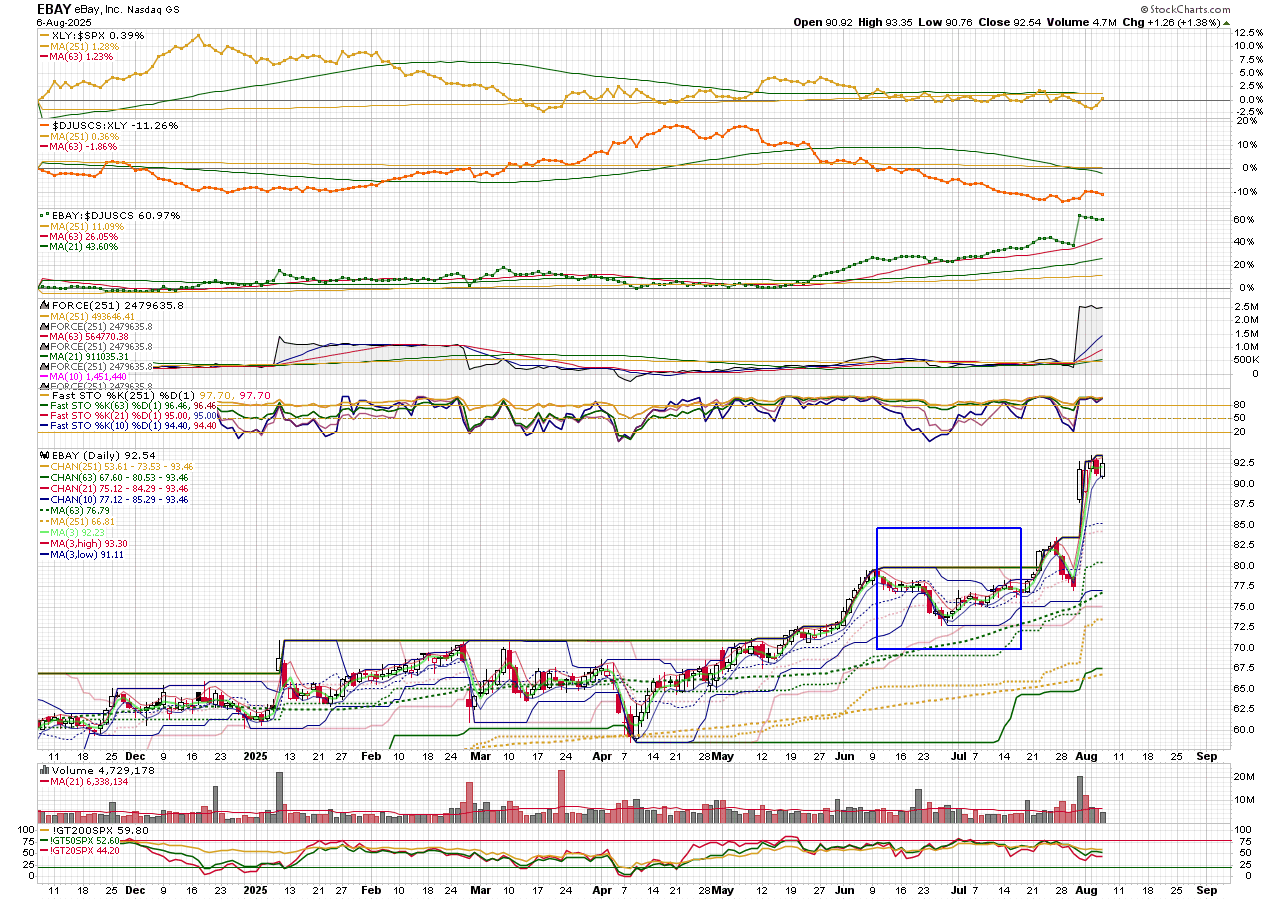

Here's another example, also scan date Jun 20.

Here again price continues down after the hit, closes above MA 3 Jul 1, then dips back below it, offering a chance to get in. This is also a good candidate because it follows a recent breakout above the 251 and 63 day upper channels and is not too far from a long basing period.

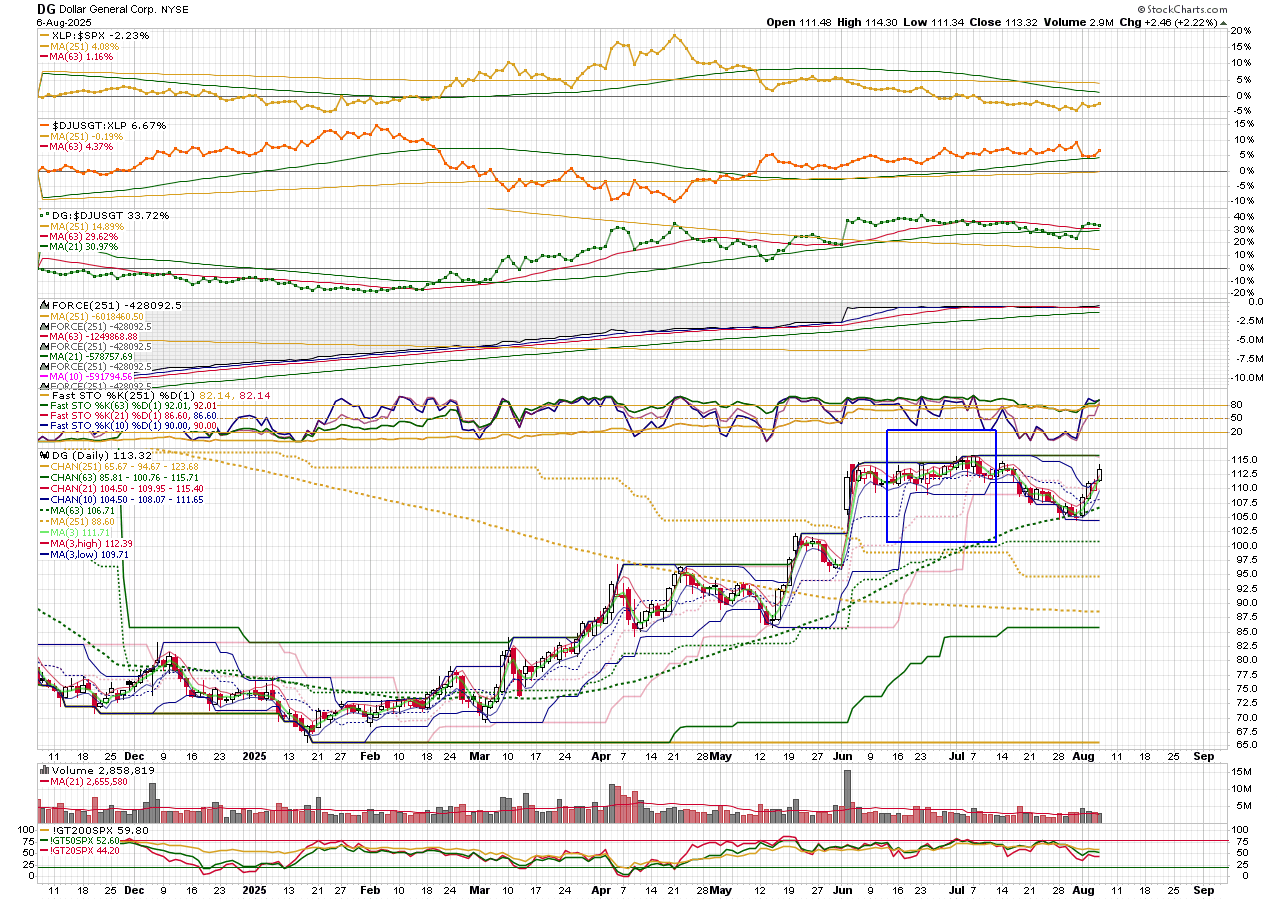

One more example:

This one doesn't work out, even though it fits all the scan criteria. The hit was the more the result of the ranging price - the channel comes up to meet price instead of price dropping to the channel. Also the big jump in price and volume in early Jun is an irregularity that interferes with the normal pattern.

p.s. specifying the sectors at the top of the scan excludes ETFs and other issues not belonging to a sector (some foreign issues, mutual funds, commodity and bond funds, etc.). I don't know if non-common stock issues respond similarly.

0

Comments

-

Thanks Mark. I like this scan.0

Categories

- All Categories

- 2.3K StockCharts

- 395 SharpCharts

- 146 Other Charting Tools

- 69 Saved Charts and ChartLists

- 1.5K Scanning

- 74 Data Issues

- 177 Other StockCharts Questions

- 218 Technical Analysis

- 155 Using Technical Analysis

- 2 InterMarket and International

- 19 Market and Breadth Indicators

- 42 Market Analysis

- 109 Trading

- 109 Trading Strategies

- 163 S.C.A.N the StockCharts Answer Network forum

- 65 Using this StockCharts Answer Network forum

- 98 s.c.a.n. archives

- 5 Off-Topic

- 6 The Cogitation & Rumination Emporium

- Forum Test Area