New Members: Be sure to confirm your email address by clicking on the link that was sent to your email inbox. You will not be able to post messages until you click that link.

Major Index Trendlines Broken? Major Correction Ahead?

Kevo

✭

Hello,

Please help confirm or refute.

$INDU Weekly - First break of lower trendline. Volume trending lower too. Lower trendline off a little. Cannot reach upper trendline:

$INDU Daily - Serious break of lower trendline. Cannot reach upper trendline:

$SPX Daily - Second break of lower trendline. Support so far at 200 day SMA. Cannot reach upper trendline:

$RUT Weekly - Seems stronger - First break of lower trendline. Yet to reach upper trendline:

Please help confirm or refute.

$INDU Weekly - First break of lower trendline. Volume trending lower too. Lower trendline off a little. Cannot reach upper trendline:

$INDU Daily - Serious break of lower trendline. Cannot reach upper trendline:

$SPX Daily - Second break of lower trendline. Support so far at 200 day SMA. Cannot reach upper trendline:

$RUT Weekly - Seems stronger - First break of lower trendline. Yet to reach upper trendline:

0

Comments

-

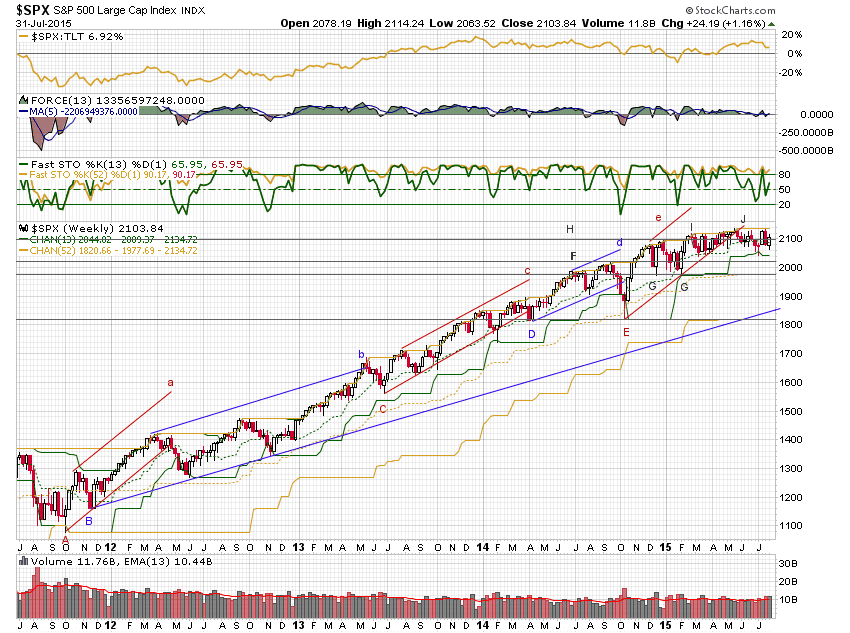

$SPX Weekly - Hugging lower trendline. First break lower trendline. Cannot reach upper trendline:

$RUT Daily - Hugging lower trendline. Major break lower trendline. Cannot reach upper trendline. Support so far at 200 day SMA:

0 -

Hi @Kevo, timely question and interesting charts. Thanks for taking the time to create them and share them.

I haven't been a big fan of trend lines, but since reading some Wyckoff, I've become more interested. It seems he actually had a pretty formal method for drawing them, which was to take two adjacent lows and the high between them to draw a trend channel. On the chart below, I've done that. I drew a new set of lines from the next two lows any time there was either a close above the upper trend line or a close below the lower trend line. Choosing the lows to draw from can be a little arbitrary, so I chose lows where the 13 week stochastic (this a weekly chart - better for long term trends, I think) touched or broke 50 after the specified close.

So, each set of trend line is marked by an upper and lower case letter, A through E.

There is also a support line F, a test of support line G and a resistance line H.

So for some comments:

Only breaks of lower trend lines A and D were followed by significant declines, and they didn't change the trend.

What's different this time is that trend line E was broken (at J) by a sideways ranging movement, instead of a sharp decline as in the previous cases.

But what is also different is that price did not react to breaking E by rallying sharply as it did in each of the other instances. A strong market will normally surge after a threat to the trend, so this lack of response is bearish.

Also bearish is loss of momentum after crossing the high at line F, where range contracts and the highs sort of move off to the right instead of continuing the climb. Add to that the failure to cross line H decisively ( at letter I and forward). The 13 week Force indicator suggests this has been a period of distribution, as you could draw a down trend line (not shown) across the descending peaks.

On the bullish side, the tests of line F at G and G showed a pretty strong response to those breaks of support (the peak at F during Sept 2014). Also, in the past two weeks, the total volume has been fairly heavy and the market has not broken down.

So I think we don't yet have sufficient evidence for a big market break.

The 13 week lower channel has caught up to the most recent support levels (above line F, in March). Price tested that level the first week of July and price bounced off it pretty well, and has held above it. If you look back, you'll see the market has moved up significantly after touching or breaking the 13 week lower channel. I would now want to see it break the upper channel in the next couple of weeks on big volume and hold above it (I can't imagine what event would trigger that). If it doesn't do that, I'd be even more wary. And if it closes solidly below the 13 week channel on volume and doesn't recover, I would be solidly bearish.

Thanks for reading. Hope it makes some sense.

0 -

Hi @markd , I read what you are saying and I am following. I have two questions.

First, the uppercase B lower trendline is extending all the way to the right-edge of the chart. This gives the mistaken impression that this trendline is still in play? I dont' think it is. Should this trendline end when "b", the upper trendline ends? Also, I notice that lower trendline "B" starts on the second low of A. Should it not start at the trough at May-June 2012? It looks like upper trendline b starts too early too.

Second, if you keep drawing trendlines in this manner, how do you know when the trend ends? Maybe it ends when the slopes of the trend channels are negative? Does Wykcoff not have some formal way of showing the longer trend has ended like via trendlines?0 -

You are correct about B-b. To follow the rule, if you start at A, line B should be drawn from the June 2012 low and line b parallel to it from the September high (after the November low).

When I was first drawing in these lines, I thought B was a good place to start because the next high was the breakout that began the trend, and it makes three touches, which, according to some makes it a more valid line. Later I reconsidered and started at A but didn't adjust B.

I should be clear about two points - one - the Wyckoff rule stops with choosing two lows and a high. For clarity, I stopped the lines and drew new ones when they were crossed. That is not Wyckoff. He is silent on when a trend line ceases to be in force. He also drew trend lines on P&F charts that did not follow this rule and probably wouldn't be accepted today.

You are correct that, to be consistent, B should end with b. But I'm not sure that B is not a valid trend line - first because it makes the three touches, and second because if you extend line b, price never gets much above it, and the market eventually sells off below it. So, intuitively, B-b seems to be a strong set of lines and it seems a reasonable guess that the market could resume the uptrend when price converges with B, perhaps at line G. But that's me talking, not channeling Wyckoff.

To your second point, as I understand it, Wyckoff didn't use trend lines to evaluate long term trends. He mainly used them to identify overbought and oversold areas (overbought - closes above the rising upper trend line, and especially a steep line; oversold - closes below a falling lower trend line), and as junctures to evaluate buying and selling strength. He would not hold a long position all the way back to the lower rising trend line - he would have been out somewhere near the top based on evidence in the price bars and volume that supply had over come demand. He would use the lower rising trend line as a point to evaluate whether sellers were exhausted coming into that line and whether buyers were returning and a new entry was available.

But Wyckoff emphasized that it was wrong to predict and you must always pay attention to the evidence that contradicts your conclusions. Many set ups don't work out. For instance, If the rising trend line were broken on big volume, that would be strong evidence that the trend is over. That's the way it looked when D was broken. You might have gone short at D, but the bar at E immediately contradicted that conclusion and you would have to close out.

0

Categories

- All Categories

- 2.4K StockCharts

- 397 SharpCharts

- 146 Other Charting Tools

- 69 Saved Charts and ChartLists

- 1.5K Scanning

- 74 Data Issues

- 177 Other StockCharts Questions

- 218 Technical Analysis

- 155 Using Technical Analysis

- 2 InterMarket and International

- 19 Market and Breadth Indicators

- 42 Market Analysis

- 109 Trading

- 109 Trading Strategies

- 162 S.C.A.N the StockCharts Answer Network forum

- 64 Using this StockCharts Answer Network forum

- 98 s.c.a.n. archives

- 5 Off-Topic

- 6 The Cogitation & Rumination Emporium

- Forum Test Area