New Members: Be sure to confirm your email address by clicking on the link that was sent to your email inbox. You will not be able to post messages until you click that link.

S&P 500 anomaly on Monday

On Monday, the Dow and the Nasdaq opened significantly lower than the S&P. The futures on the S&P showed it hitting around 1830 right at the open which is where the "equivalent" open of the Dow and Nasdaq were. How come it officially only went to 1867, when if you look at a chart of how the other indices opened, the S&P would've hit ~1830 as the futures indicated. Were there circuit breakers enacted on the S&P that were not on other indices? The reason I ask is because I am trying to determine whether that key support level was technically reached or not. There were trades on the SPY that were the equivalent of S&P 1830 at the open as well, confirming the futures and also in-line with the other indices open. (Note: You can also see this distortion by the extreme rally in the Dow and Nasdaq compared to the stagnant S&P 500 in the first few minutes of trading).

Thanks!

Thanks!

0

Comments

-

Wow. Interesting and detailed observation; Just a quick comment; more will come later maybe if I think of other things. I do not know if this is the explanation, but it is just an idea:

Since SPY is an ETF, it is subject to buying and selling pressure. We know ETFs differ from its Net Asset Value (NAV) a little and is re-balanced. (I'm not sure how often; daily maybe?) $SPX is not subject to buying and selling pressure and does represent the NAV of the index.

It could be that SPY was under a lot of selling pressure at that time and may have differed more than usual from it's NAV during that time. Whereas $SPX would be more accurate since it was not subject to buying and selling pressure.0 -

I searched for an official document on how the sp500 is calculated intraday, but didn't find what I was looking for. However, if I remember correctly, it works this way - others should correct me if they have more specific and more accurate information- : since not all stocks open simultaneously, but there is a need to display an opening value, the opening value displayed is calculated using the opening price of stocks that have opened, and the prior close of a stock until it does open. So on some days, all stocks open more or less together, and the opening value is adjusted minutely if at all, and on other days, there can be a more significant adjustment. As @Kevo notes, the index itself does not actually trade, but the etfs and futures based on it do, and the etfs and futures are not bound to follow the index tick for tick, although arbitrage usually keeps them pretty close (except when the futures are trading but the stocks are not).0

-

Hi Kevo and markd,

Thank you for responding, and thanks for the insight markd regarding market operations, and Kevo regarding the ETF. I guess the only thing still that I still find odd, is that (if we take away the ETF part, and assume the other indices work as you described for the $SPX), the $SPX opened down 5% (1970-1867), yet the $INDU opened down nearly 6.6%, $COMPQ opened down 8.8%, and $NYA (which basically mirrors $SPX), opened down 6.7%. In other words, given all of these opens, $SPX should have opened at least 6.6% down, or around the 1830 level where the futures hit at 9:30:00 am. To me, it just seems that the $SPX should of had a low of around ~1830 even if it was just for a minute or two like the other indices. And then when the other indices rallied 2% in the first few minutes, the $SPX just stayed neutral, suggesting that they had to catch back up to equilibrium before they moved together again. Thoughts?

0 -

I did more thinking and figuring on this. I looked at the Percent Difference from the close on 21AUG to the lowest morning low on 24AUG of the 9 sector ETFs. Here are the results:

XLK down 20.81%

XLY down 11.27%

XLI down 7.56%

XLB down 8.91%

XLE down 7.47%

XLP down 8.37%

XLV down 21.00%

XLU down 3.15%

XLF down 21.64%

XLK, XLV, and XLF fell the hardest at more than 20% each. Whereas XLU fell the least. XLE and XLB (Materials) didn't fall as hard since they were already substantially down.

$NDX has zero Energy, Materials, and Utilities. 0% representation of these 3 sectors. By extension, $COMPQ is similar since it is mainly Technology, Biotechs (XLV), Healthcare, Financials, and high beta.

$NDX is mainly Technology, Biotechs, and Healthcare; no Financials.

$INDU has 2 Energy and 1 Material, and 1 Utility representation. E&M is 10%. The 1 utility, Verizon, fell 17.51% that morning. For practical purposes, Verizon did not help $INDU.

$INDU has 5 Technology, 4 Healthcare, and 5 Financials. 14/30 = 46.6% of index.

$SPX has 38 Energy (7.6%) , 25 Materials (5%), and 37 Utilities (7.4%). $SPX E&M represents 63/500 = 12.6% of the index. Combined with Utilities that 20% of the index. Compare to the 10% of $INDU.

$INDU and $COMPQ has more Technology, Healthcare, and Financials; the 3 that fell the hardest.

$SPX was cushioned somewhat by Utilities. It was the only index of these 4 mentioned to get such a cushion. Also, I think it was helped some by E&M since E&M had already fallen the previous 2 months.

Thoughts?0 -

I think @Kevo has the right slant on this. Different indices have different components and different methods of calculation, and so they don't have to move together. Also, the SP500 represents all sectors, but it is mostly big cap and mostly seasoned issues that have longer term ownership - most of the time these stocks are less volatile than the components of of indices with more smaller and mid-cap and new companies. These are less well entrenched in their market niches - so their earnings are more volatile - so they attract a trading crowd - often using margin - who act more impulsively, or are forced to act by their brokers/lenders.0

-

Here is a third take on this...

But first, here is a quote from an article on ETFMeter.com:S&P 500 ETFS SHOWED DOWN-SIDE TRACKING ERROR

The full article is here: http://www.etfmeter.com/blog.aspx?id=4425

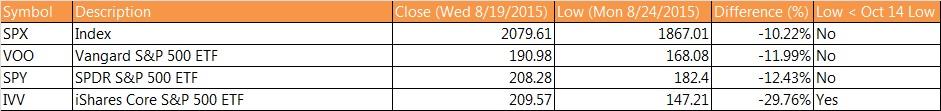

We measure the decline in the S&P 500 Cash index (SPX) from the Wednesday, Aug 19 close to the Monday, Aug 24 low. We want to check how well the S&P 500 ETFs did in tracking this downdraft. In Figure 3 we show that amplitude of the move from the Wednesday close to the Monday low. There was significant tracking error, particularly for the IVV ETF, which seemed to lost its bearings altogether. Hence, in designing portfolios, one should recognize that the down-side risk could be greater than that experienced by the index itself.

Tracking Error downside

Figure 3: There was significant down-side tracking error among popular S&P 500 tracking funds and the IVV made a much lower low (below the October, 2014 low) where as the index stayed above that low.

VALUE, DIVIDEND, EQUAL WEIGHT ALTERNATIVES TO SPX FARED WORSE

One of the portfolio construction principles suggested to reduce volatility and give down-side protection is to use a value approach, or have high dividend payers or change the weighting scheme. We show in Figure 4 that none of these alternatives gave any meaningful down-side protection. So, from a portfolio design perspective, it might be better to just use a good SPX ETF.

Figure 4: ETFs focused on value, dividends and alternate weights fared worse in the sell-off then the SPX.

====================

The third take has to do with index arbitrage (like markd mentioned) and Program Trading. ETFs, Futures Contracts, and the SPX Cash Index are different instruments/markets/etc. I read something about the futures e-mini S&P500 (ES) and the SPY fair-value can be off the Cash Index, and thus Arbitrage and Program Trading has to take place. All of this is completely foreign to me, and I have no clue what this is. I did collect some reading material from Google, but it will take time to go through it and figure it out.0 -

Wow, excellent research there Kevo, thank you (and apologies for the delay as I have been out of town). I think you are spot with your analysis of the different sectors influence on the indices at the open. And yes, regarding that article, there was definite tracking error with the ETFs at the open, I was just surprised to see this occur in major stocks as well such as Apple and Verizon. I'm speculating that the HFTs just got out of the way, and as markd said, traders and margin calls seemed to take over sending those stocks well out of fair value at the time. All in all, I guess we can conclude that this happened during a lack of liquidity at the open, which happened to hit the tech, healthcare, and financial sector extremely hard, thus explaining the much steeper open in the $COMPQ and the $DJIA. Thanks again guys, I have never seen an open like that before so I really appreciate all the research/analysis in solving this.

0

0

Categories

- All Categories

- 2.3K StockCharts

- 397 SharpCharts

- 146 Other Charting Tools

- 69 Saved Charts and ChartLists

- 1.5K Scanning

- 74 Data Issues

- 177 Other StockCharts Questions

- 218 Technical Analysis

- 155 Using Technical Analysis

- 2 InterMarket and International

- 19 Market and Breadth Indicators

- 42 Market Analysis

- 109 Trading

- 109 Trading Strategies

- 163 S.C.A.N the StockCharts Answer Network forum

- 65 Using this StockCharts Answer Network forum

- 98 s.c.a.n. archives

- 5 Off-Topic

- 6 The Cogitation & Rumination Emporium

- Forum Test Area