New Members: Be sure to confirm your email address by clicking on the link that was sent to your email inbox. You will not be able to post messages until you click that link.

improving pullback scan

http://scan.stockcharts.com/discussion/643/scanning-for-pullbacks#latest

@markd

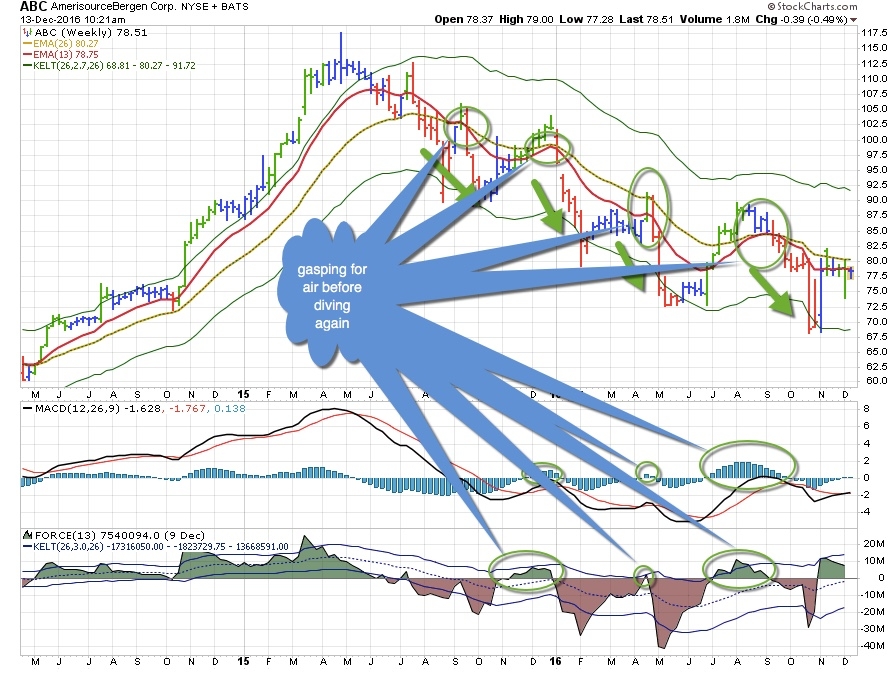

most of the stocks i find attract I've have a false break out on the weekly chat and closes higher than the previous week did like the attachment.

i would also like to find a false break out that closed higher and the next week closed higher as well see number 2

is there a way i could do my other can with just part one and one with both 1 and 2 to see what kind of results with both

Thanks

@markd

most of the stocks i find attract I've have a false break out on the weekly chat and closes higher than the previous week did like the attachment.

i would also like to find a false break out that closed higher and the next week closed higher as well see number 2

is there a way i could do my other can with just part one and one with both 1 and 2 to see what kind of results with both

Thanks

0

Comments

-

Well, the first scan is straightforward. You just want to make two comparisons - this week's low to 1 week ago low, and this week's close to 1 week ago close.

So I'll let you put this into real scan language

weekly low less than 1 week ago weekly low

weekly close greater than than 1 week ago weekly close

The second scan is the same as the second line of the first scan - you just want to compare the weekly closes - one is greater than the other. BUT, if you want to combine the two scans together, you are looking at three weeks altogether, the current week, 1 week ago and two weeks ago. So you have to adjust the first scan to look at 1 week ago and 2 weeks ago. If you get stuck, post what you have.

Good job hunting down a promising set up.

0 -

Is that the Karr lovvorn atr0

-

Karry lovvorn I mean0

-

sorry for the late reply but yeah @MadRoofer I got the idea from him0

-

ok @markd last scan didnt quite give me what i wanted ive been looking at one price bar i gota start looking at them as a whole so.....what i notices is the pattern in price i think i want, lets say somthing is in a downtrend, i want to short after the fast ema comes up toward the slow ema, it may touch/exceed it may not, but once it turns down( im thinking the previous clouse would have to be down plz correct me if im wrong)is when i want to enter the trade. i hope i explained this well enough ive included a chart ive marked up

thanks in advance for your reply i appreciate it

0 -

It's pretty difficult to write a scan that is exactly what you want, because the market has so many ways of doing its thing.

Instead of writing a scan that pinpoints a particular set up right down to the last detail, you could write a scan based on one or maybe two of the common elements you see in each situation you want to capture.

Based on the chart example above, you might write a scan that just looks for the MA 13 less than some number of bars ago, and a close ABOVE it. A close above a down trending MA is a counter trend event, and if the trend is still strong, the trend should come back AFTER that event. The problem is, you don't know how many bars will go by before the trend comes back, or how far up it will continue.

One way to deal with that is put your hits in a watch list and put an alert under each higher low. Then decide whether to take the trade when you get the alert.

Or you could test for the MA falling and one of the other indicators doing something counter trend - like Force getting above zero, or MACD Hist getting above zero.

But keep in mind, stocks have many different ways of trending both down and up, which means two things: your scan will miss stocks that are trending down that you wish you could have caught, and the stocks you do catch may not behave as you have seen in the charts you found that gave you the idea. That's just the way it is. Some scans are better than others, but none gets only winners.0 -

ok i get that how would i go about writing this scan a friend sent to me but i want to know the"easy way" and the WRITE IT OUT way if that makes sense0

-

1. A stock touched its upper Autoenvelope within the past 26 bars

2. That stock is now under its 26-bar EMA OR has been under it within past bar

0 -

The first condition would require you to check each of the last 26 bars individually. A lot of work. It would just be high > upper ma envelope, with a parameter(s) for the ma, but you would have to repeat 26 times (1 day ago, 2 days ago, etc. ) and connect them all with "or" s. Then add the low < less than ma 26. The scan language isn't really designed to do that sort of thing - it can, but it's alot of work.0

-

OK thanks i think i get what you are saying0 -

ok i have a question similar to the last on e at @markd i have a scan i made just using just the drop down i added it in this conversation how do i check to see if the low has touched or exceeded the ema and closed above it within the last 5 days, cna that be down in the drop down or does that have to happen in the advanced scan workbench? and also what downs multiplier at the end mean?

0 -

that should be *can* i make it search

0 -

You can either test once for the condition occurring today - i.e., low below ema and close above ema and then run the scan for the past five days by setting the calendar to each day,

or, you can write the scan to test each day - low below ema and close above ema; or 1 day ago low below one day ago ema and 1 day ago close above 1 day ago ema; or 2 days ago low below...etc.

If you write the longer scan, you need to use an "or" statement, so watch your brackets. I never learned how to use the scan builder interface you show above, so you are on your own there, unless someone else wants to jump in.0 -

ok I I think I get it thanks0

Categories

- All Categories

- 2.4K StockCharts

- 397 SharpCharts

- 146 Other Charting Tools

- 69 Saved Charts and ChartLists

- 1.5K Scanning

- 74 Data Issues

- 177 Other StockCharts Questions

- 218 Technical Analysis

- 155 Using Technical Analysis

- 2 InterMarket and International

- 19 Market and Breadth Indicators

- 42 Market Analysis

- 109 Trading

- 109 Trading Strategies

- 162 S.C.A.N the StockCharts Answer Network forum

- 64 Using this StockCharts Answer Network forum

- 98 s.c.a.n. archives

- 5 Off-Topic

- 6 The Cogitation & Rumination Emporium

- Forum Test Area