New Members: Be sure to confirm your email address by clicking on the link that was sent to your email inbox. You will not be able to post messages until you click that link.

Scanning for pullbacks

I'm a COMPLETE beginner and I was wondering what is the best way to scan for charts with pull back potential. I don't know how to write my own scans(yet) are there any predefined scans I could use on a site like stockcharts.com or finviz.com also with the way the market has been goin lately should I be looking for Longs or shorts? I have been looking for Longs but don't really see the kinds of charts I'm looking for (which would be a stock in an uptrend on both the Weekly and daily charts that are falling on the right edge of the dailies) I thought about jus giving the whole idea of trading up last night but I really think my ADHD is kicking in and I'm jus making this to hard in my head..I don't want to throw in the towel its one of the VERY FEW things I'm interested in learning

0

Comments

-

If you are serious about having ADHD, I'm not sure trading is something you might enjoy. There's an awful lot of waiting for the right situations to come around, and then more waiting once you are in a position. But you are the best judge of that.

It does take a while to learn to use a site like Stockcharts, so you shouldn't expect to just jump in and start scanning and trading right away. I don't think anyone completely new does that. Even someone with trading experience would need to take time to learn how to use all the tools here. On the other hand, everyone learns differently, so if you are one who needs to learn by doing, and can afford to lose money for a while as you learn, then you might start actually trading sooner.

I would suggest a few things. Watch the videos on scanning in chart school - and as many of the others as you want. Here's the link:

stockcharts.com/videos/

Then, look at some charts - put different different indicators and overlays on them to see what they look like when you see a trade set up you like - like the dip in an up trend you mentioned. You might want to try Slow Stochastics, or maybe two moving averages like 21 and 5. Or pick some others from Chart School after you read up on them. Look at A LOT of charts. Maybe start with the SPDR etfs - XLE, XLB, XLI, XLY, XLP, XLV, XLF, XLK and XLU. When you find one or a few that are trading the way you like, then look at individual stocks that belong to the same sector(s). For instance, XLE is the Energy Sector and XOM (ExxonMobil) is a stock in that sector. Look for stocks that look like they might be doing the same thing as the etf - that is, the same indicators or overlays are doing the same thing - or just did, or are about to. Those stocks have a better chance of being a better trade.

When you find an indicator or overlay - or maybe a combination - that you would like to take a chance on, then it's time to start building a scan, and we can help you with that.

I know it seems like a long haul, but if you give yourself a chance, make a plan to learn and then set aside some time on a schedule of your own choosing, you can chip away at it until you see real progress. If it's not for you, that's fine, too, but give it a chance before you decide. Pop your questions up here as you go along. Somebody will answer.0 -

Hey, conquer1, sorry that answer was somewhat repetitive of my earlier answers to your questions. I didn't recognize your avatar for a while.

Choose an indicator you want to work with and we'll write something. Doesn't matter which one - have to start somewhere.0 -

Thx markd your comment holds more info then what i have i appreciate that and yea the ADHD thing is real but like i said this is one of the FEW things that has kept my attention i do realize its not going to be easy i just get frustrated when im stuck its not like i can just run out and find a mentor like you could in carpentry or somthing i appreciate you answering any of my questions and im the type thas to learn by doing and reading if i have to loose money to learn to make it (even thon right now im jus trting to paper trade) so be it i know now to cut my losses short im just ready to actually learn i know the money will come after i don't expect it overnight i expect to go to bed every night with a little more knowledge on the subject than i woke up with0

-

OK, well here's a simple way to get started looking at charts. Copy and paste this scan into the advanced scan window:

Note: the lines that begin with "//" are comments - the scan engine doesn't see them; you can delete them if they clutter things up.

// BEGIN SCAN

// choose stocks to look at

// easy way is to choose from Indexes and ETFs drop down

// scan writing note: the first line NEVER begins with "and"

[group is sp600]

// find stocks in a long term up trend

// 200 day MA is higher than a month ago

// scan writing note: every line after the first MUST begin with "and"

// or "or"

and [sma(200, close) > 21 days ago sma(200,close)]

// the 50 MA is above the 200 MA

// scan writing note: sma( ) is a "function" -

// you can tell its a function because

// it begins with some letters and includes stuff between parentheses ( )

// the stuff between the parentheses is called the parameters -

// there are usually one, or two or three parameters

// a function is a built in operation that does a complex calculation for you

// this one calculates a moving average

and [sma(50, close) > sma(200,close)]

// this looks for the indicator signal

// %D is the moving average of %K (read the chart school article on Stochastic)

// the "x" says, crosses above

// so the signal is %D (red line on the chart) crosses above the 20 line

and [Slow Stoch %D(14,3) x 20]

// END SCAN

You can edit [group is sp600] to sp400 or sp500 or anything else you want

You can edit 14, 3 - maybe try 21, 5

You can edit the 20 - maybe move it up to 25 or 30

You can run this scan for days in the past by selecting a date from the drop down calendar above the advanced scan window.

When you get the results put them in a list and format the charts with the SCC default chart style (there are videos about chart styles and lists) and change the MACD indicator to the Slow Stochastic indicator. If you change the 14,3 to 21, 5 in the scan, you also have to change the parameters for that indicator on the chart.

Then review the results - make the chart maybe six months or a year long. Find all the trades that Slow Stochastics signalled - where the red D line crossed above the 20. It will give you an idea of how often the signal "works".

Note: if you select a date in the past for your scan, your chart will still come up dated for today. If you want to see how the chart looked on the scan date, you have to reset the dates using "Select Start/End date" under Chart Attributes - Range on the chart workbench. Also check out the tool next to "Extra bars". If you click on the right end arrow, it advances the chart one bar at a time, so you can walk through a trade.

Then you can try to figure out what's the difference between the winning and losing trades and is there another indicator or overlay or condition (like above or below an MA, or something else) that will filter out the bad trades.

It's a lot of detective work, but if you like it, it's fun.0 -

ok thank you for that you actually answered a few other questions i had wit this reply i going to review some videos on stock charts then i can start with the work bench and scan i really appreciate all your help0

-

ok one year later and I think I am finally ready to get to real detective work. what I want ( I will use a long trade as an example, just reverse everything for a short) is a stock that was recently going up made a new hi ill say within the last 20 or so bars, that as come down to or in-between its moving averages. ( I will be using two EMAs a 14 period and a 28 period). I would like the stock to make a new recent low and then turn back upwards( false breakout) I would like the day I were to be scaning to show the stocks that im interested in to have closed the most recent day up in price. I will also want the macd histogram to have moved up on this day as well ( just the standard 12 26 9). this wont be a necessity on the weekly( or which ever is my longer time frame) chart ( which i am using to get a feel for over all direction) im more so looking for the macd movement on the shorter time frame chart.

thank you in advanced,

Conquer10 -

down to EMAs inbetween emas or under emas ( preffered)*******0

-

Well, that's pretty complicated. What do you have so far?0

-

So far nothing just getting started is there a way i can get some parts of what im looking for tgen manually look for the rest?0

-

what about for the scan a stock that is up for the month, but has fallen to or below its 10day Ema but the most recent close was up?0

-

You can find some sample scans here that you can borrow from to get you started. The easier price scans are toward the bottom.

stockcharts.com/school/doku.php?st=sample+scans&id=chart_school:scan_library:sample_scans

I think you want to think about building the scan backwards from the way you are saying it -

write a line for today's close is greater than one day ago close - and test it until it works

then, add a line for today's close is less than the 10 day ema of closes - and test both until they work.

Then to get a recent high price - this is harder - a line for the max price, meaning the highest high, within some number of days ago (you decide) is greater than the max price, again, the highest high, beginning of some number of days before the recent high and looking back some number of days - so - something like:

and [ max(?, high) > ? days ago max(?, high)]

or another way might be

and [max(?, Upper Price Chan(?)) > ? days ago Upper Price Chan(?)]

You have to fill in the ? with numbers that you think might work from looking at your charts. It's hard work and you have to do a lot of thinking, but that's how it gets done.0 -

I follow most of it up until the finding the high part i kinda get it ....is there a way to scan to see if the elder impulse is a certain 2 colors like BLUE and GREEN instead of just one color (green) and/or a way to see if say it was red/blue 10 days ago and is now green/blue?0

-

You can select Elder bars from the Candlestick Patterns drop down (not the Technical Indicators drop down). To get some number of days ago, put the phrase "10 days ago" in front of it.

and [10 days ago Elder Bar Green is true]0 -

O ok thanks0

-

ok I think I'm getting it I see I need to jus do one step at a time and then add once I find what I want step by step....so the first thing I need to find is a stock in a down trend would you recommend the upper price channel is LOWER say 0 amount of days ago, compared to 10 days ago for a down trend, and using the lower channel line is HIGHER 0 amount of days ago, compared to 10 days ago for a up trend. am I thinking in the right direction to get me started?0

-

Using price channels is one way to do it - but, price channels can stay flat for a while, so you would have to think about the length of the price channel and then the length of the look back period (x days ago). The look back period should be longer than the price channel length. You would have to experiment to see how much longer.

Another way would be to check whether a moving average of some length is higher (for an up trend) than some number of days ago - maybe 10 days for the 50 day average or 20 days for the 200 day average.0 -

thanks for all of your help, it seems what I what is my weekly 13 period ema to be lower than weekly 26 period ema, then I would like for my daily 13 period ema to be above my daily 26 period

0 -

OK. So for the weekly emas,

select ema twice from the Technical Indicators drop down

edit to put both emas on the same line with a less than operator between them

edit the first ema so it says 13 and close

edit the second ema so it says 26 and close

then, for both, put "weekly" in front of "ema" and also in front of "close"

And for the daily emas, almost the same thing

select ema twice from the technical indicators drop down

edit to both on one line with a greater than operator between them

edit the first ema for 13 and close

edit the second ema for 26 and close

you don't need to modify with "daily" because the scan engine assumes you mean daily unless you put something else in front of it (like "weekly" as we did above).

If you get stuck, post what you have.

You did a great job to narrow down just exactly what you want for indicators and how they should be in relation to each other. Once you figure out specifics that way, its much easier to write the scan. Basically, when you write a scan, it's just describing exactly what you see on your chart, as you did here in plain english, but in scan language. Congrats!

0 -

thank you I appreciate all the help now it seems that the stocks I am getting are to far under the emas (for shorts) to far above the emas for longs. like the move has already been underway and i shouldve gotten there like 2 3 weeks ago, when i short a rally in a down trend i want something that is just turning down i.e. down 1,2,3, days not something that has been down 2 weeks or the opposite for shorts i need a way to find stocks that are higher up starting to turn down for shorts or still under the ema and starting to come up for longs i cant think of a way to do this0

-

You could try testing for a shorter ema that has turned down after rising. Let's say ema(5,close) - you could also experiment with ema 3, or ema 7 or 10, etc.

We'll assume you have other lines in the scan that look for stocks in a longer term down trend.

So first, you want to test that the short ema has been rising. You can do that by comparing the current value of the ema to its value some number of days ago - let's say 5. Again, you could experiment with different numbers.

and [ema(5,close) > 5 days ago ema(5,close)]

Then you want to test that the short ema has turned down - or looks like it wants to turn down.

and [ema(5,close) < 2 days ago ema(5,close)]

These conditions are only meant to find stocks where buyers have shown some weakness that might lead to more weakness. You wouldn't necessarily enter right away. Sometimes stocks do go straight down once they turn, but other times there is a reaction back up, sometimes to a new higher high (for that rally), sometimes short of higher high.

0 -

OK thank you for the idea im going to try that out and see what i come up with i should of just asked this a long time ago instead of trying to struggle on my own0

-

No, the struggling is good. That's where the learning comes from - eventually.0

-

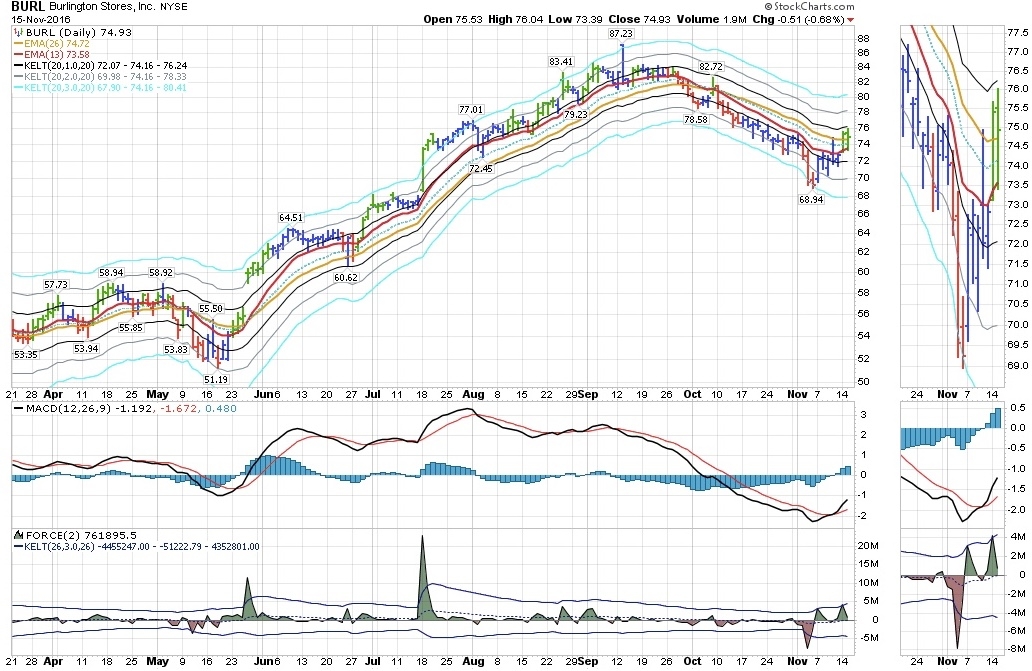

i'm just now getting the chance to use the scan and really look at it, I was at a traders camp run by dr. Alexander Elder author of trading for a living this past week, these are a sample of some results I am getting.I used a 26 and a 3 day like we talked about above what I want now is a way to catch this a little sooner like a week before its moves up beyond the emas. like when it is is still blue and just starting to go up the weekly is fine, I us want to catch it a little bit earlier on the daily. these charts are from re results of a scan on tuesday if i remember. also attatched is the scan that i used.

thanks in advanced,

0 -

You would have to identify the conditions that exist on the daily before the weekly crossover. I don't know what those conditions are. You might try something like the the three day ma crossing above the 10 day ma. I think Elder probably waits for the weekly crossover to minimize false signals - crossovers that don't follow through. You can lose money being too early as well as too late (only if you are too early, you lose real money, whereas if you are late you just lose an opportunity).

If you identify some conditions you like, and write it out in (very specific) ordinary language, I'll help you put it into scan language. Also, maybe let's start a new thread. This one is getting very long.0

Categories

- All Categories

- 2.3K StockCharts

- 397 SharpCharts

- 146 Other Charting Tools

- 69 Saved Charts and ChartLists

- 1.5K Scanning

- 74 Data Issues

- 177 Other StockCharts Questions

- 218 Technical Analysis

- 155 Using Technical Analysis

- 2 InterMarket and International

- 19 Market and Breadth Indicators

- 42 Market Analysis

- 109 Trading

- 109 Trading Strategies

- 163 S.C.A.N the StockCharts Answer Network forum

- 65 Using this StockCharts Answer Network forum

- 98 s.c.a.n. archives

- 5 Off-Topic

- 6 The Cogitation & Rumination Emporium

- Forum Test Area