New Members: Be sure to confirm your email address by clicking on the link that was sent to your email inbox. You will not be able to post messages until you click that link.

How would you scan for ABX (Barrick Gold) to buy it early (Jan. 2016?) as it increases in price?

in Scanning

Barrick Gold has risen in price from $5.88 to $23.47 from September 2015 to July 2016. How would you be able to set up a scan to determine that it would rise up in price?

0

Comments

-

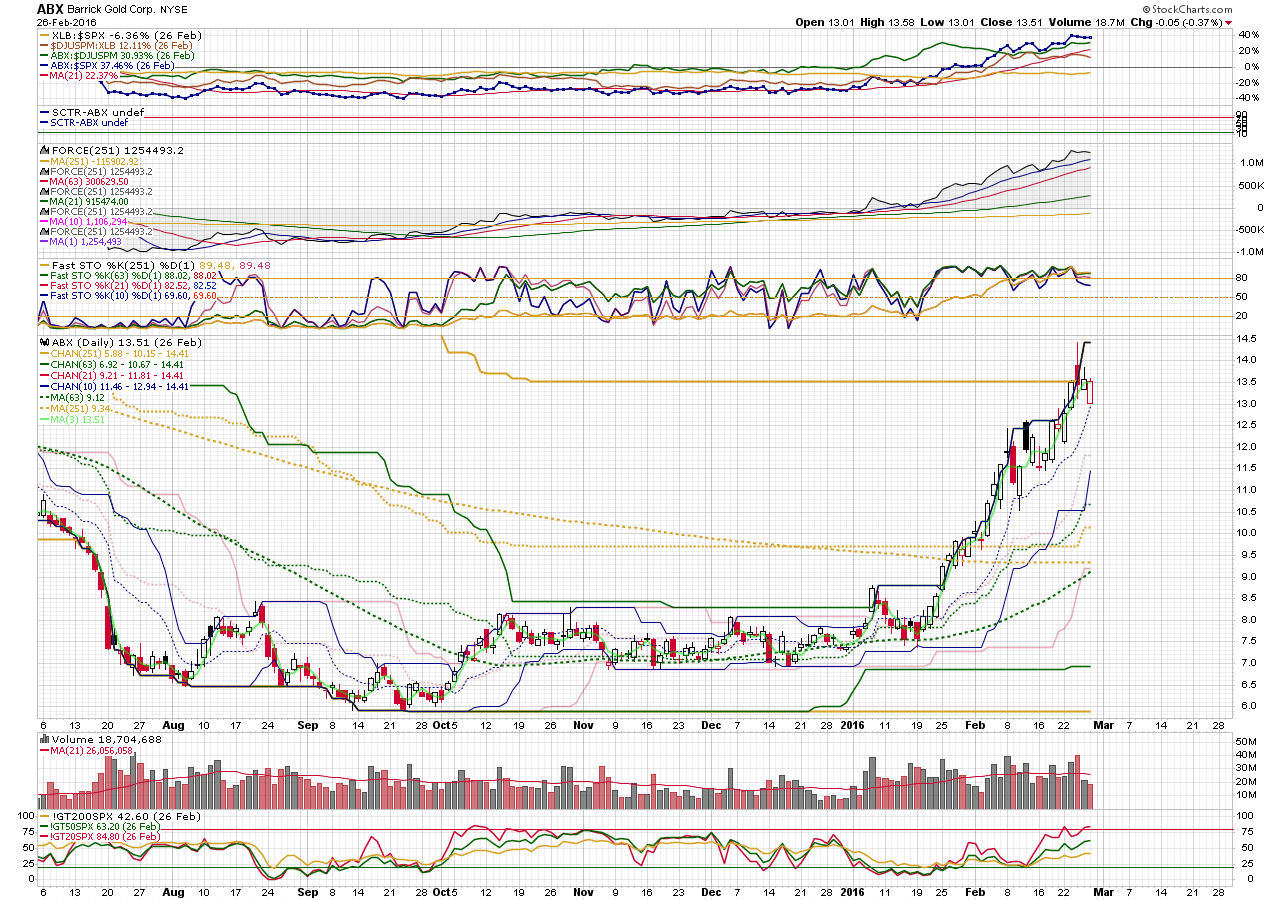

Scans don't tell the future, they can just alert you to promising situations, if you can identify the right characteristics. In this case, there was a clear breakout that you could have scanned for using price channels (with the right parameters). Then you would have had to inspect the chart to identify other characteristics. This chart shows several weeks of accumulation and huge volume on the breakout, and strong volume after the breakout, all signs of a stock that wants to go. But that doesn't tell you then and there how far it will go (although, the Wyckoff point and figure approach could give you an estimate - see the Wyckoff blog on SC).

So the scan would have been (in hindsight)

// get a longer channel line that hasn't been broken for a while

and [1 day ago Upper Price Chan(63) = 30 days ago Upper Price Chan(63)]

// get the channel cross over

and [close x 1 day ago Upper Price Chan(63)]

or some variation of price channel length and look back period.

Then you would look at the chart and check for promising accumulation. Typically, like this example, it occurs while price is in a range just above a long term bottom. Maybe OBV or Acc/Dis would show accumulation, too, but I like to use Force with some custom parameters. You can see that while price is in a range, the longer term (63) MA of Force (green line) is rising, so over the long term, buyers are taking on more stock than sellers are selling. You also see lots of high volume up close bars - more than down close bars.

This stock also has improving RS in its group. See the general up slope of the green line in the top window (ABX:$DJUSPM) which also pops with the breakout on 1/7. (note: if you click on the smaller image, it should display full size).

0 -

I have a scan that searches for long term reversals. ABX - until January of this year - had been in a pretty severe downtrend for quite some time. Same for about any other gold / silver stock. [See also CDE, AG, GLD, JNUG, SILJ, DRD, SBGL, MUX, MAG, PAAS, SLW etc. All of these launched early this year.)

This same scan also caught all the oil company reversals in March/April as well...

The scan uses a 50 day moving average (which the slope must be ever so slightly positive). It also uses the Chandelier Exit Line, default settings.

Here's about 15% of the scan text:

[type = stock] AND [Daily SMA(20,Daily Volume) > 100000]

and [Chandlr(22,3,long) x SMA(50, Close)]

and [today's close > Chandlr(22,3,long)]

and [close > 0.55]

and [close < 130]

and [slope(50) > 0.12]

and [5 days ago Chandlr(22,3,long) < 5 days ago SMA(50,Close)]

and [4 days ago Chandlr(22,3,long) < 4 days ago SMA(50,Close)]

and [3 days ago Chandlr(22,3,long) < 3 days ago SMA(50,Close)]

and [2 days ago Chandlr(22,3,long) < 2 days ago SMA(50,Close)]

and [6 days ago Chandlr(22,3,long) < 6 days ago SMA(50,Close)]

and [7 days ago Chandlr(22,3,long) < 7 days ago SMA(50,Close)]

and [8 days ago Chandlr(22,3,long) < 8 days ago SMA(50,Close)]

and [9 days ago Chandlr(22,3,long) < 9 days ago SMA(50,Close)]

and [10 days ago Chandlr(22,3,long) < 10 days ago SMA(50,Close)]

and [11 days ago Chandlr(22,3,long) < 11 days ago SMA(50,Close)]

and [12 days ago Chandlr(22,3,long) < 12 days ago SMA(50,Close)]

and [13 days ago Chandlr(22,3,long) < 13 days ago SMA(50,Close)]

and [14 days ago Chandlr(22,3,long) < 14 days ago SMA(50,Close)]

and [15 days ago Chandlr(22,3,long) < 15 days ago SMA(50,Close)]

and [16 days ago Chandlr(22,3,long) < 16 days ago SMA(50,Close)]

and [17 days ago Chandlr(22,3,long) < 17 days ago SMA(50,Close)]

and [18 days ago Chandlr(22,3,long) < 18 days ago SMA(50,Close)]

I continued this test for 19 days ago, 20 days ago, etc. until about 110 days..... which is about 1/2 of a trading year.

It took a lot of cutting, pasting, etc. to keystroke all that in - and used about 7,200 key strokes of the scan allotment....most of them, in other words.

So the stock must be in a continuous downtrend for nominally 1/2 year (or more) for this scan to catch it. Many days this scan finds nothing. What it does find will have some very crappy SCTR rankings, often in single digits. It's picking a bottom in a stock that's been in a 6 month downtrend, after all.

It triggers when:

1. the average volume over 20 days of the stock is at least 100,000 shares - so no thinly traded stocks.

2. The SLOPE of the 50 day simple moving average is 0.12 or greater -- the 50 day moving average has turned at least a little positive.

3. Today's close is ABOVE the Chandelier Long line.

4. The close price is at least 55 cents.....no 6 cent penny stocks will be found.

5. The close price is less than $130 - had to cut it off somewhere.

6. And THE KEY - the Long Chandelier line CROSSES OVER the 50 day moving average.

7. The OTHER KEY - the Long Chandelier line has NEVER been greater than the 50 Day Moving average for 110 or more CONSECUTIVE days.

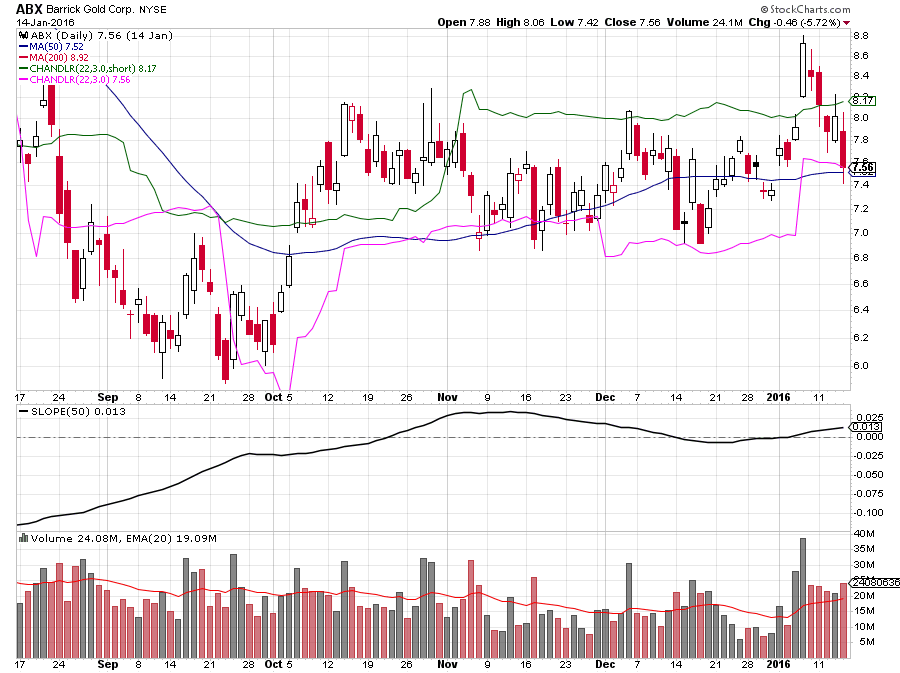

This scan found ABX in the first week of 2016, at about $8.50 - $9.00 per share. The Chandelier Exit line and/or the 50 Day moving average have been a very valid trailing stop for all of that time.

In just about the same time frame, it also found all those other stocks I listed above, and quite a few oil and gas stocks a couple of months later. Many of them are up $20-$40 per share now.0 -

I have a scan that searches for long term reversals. ABX - until January of this year - had been in a pretty severe downtrend for quite some time. Same for about any other gold / silver stock. [See also CDE, AG, GLD, JNUG, SILJ, DRD, SBGL, MUX, MAG, PAAS, SLW etc. All of these launched early this year.)

This same scan also caught all the oil company reversals in March/April as well...

The scan uses a 50 day moving average (which the slope must be ever so slightly positive). It also uses the Chandelier Exit Line, default settings.

Here's about 15% of the scan text:

[type = stock] AND [Daily SMA(20,Daily Volume) > 100000]

and [Chandlr(22,3,long) x SMA(50, Close)]

and [today's close > Chandlr(22,3,long)]

and [close > 0.55]

and [close < 130]

and [slope(50) > 0.12]

and [5 days ago Chandlr(22,3,long) < 5 days ago SMA(50,Close)]

and [4 days ago Chandlr(22,3,long) < 4 days ago SMA(50,Close)]

and [3 days ago Chandlr(22,3,long) < 3 days ago SMA(50,Close)]

and [2 days ago Chandlr(22,3,long) < 2 days ago SMA(50,Close)]

and [6 days ago Chandlr(22,3,long) < 6 days ago SMA(50,Close)]

and [7 days ago Chandlr(22,3,long) < 7 days ago SMA(50,Close)]

and [8 days ago Chandlr(22,3,long) < 8 days ago SMA(50,Close)]

and [9 days ago Chandlr(22,3,long) < 9 days ago SMA(50,Close)]

and [10 days ago Chandlr(22,3,long) < 10 days ago SMA(50,Close)]

and [11 days ago Chandlr(22,3,long) < 11 days ago SMA(50,Close)]

and [12 days ago Chandlr(22,3,long) < 12 days ago SMA(50,Close)]

and [13 days ago Chandlr(22,3,long) < 13 days ago SMA(50,Close)]

and [14 days ago Chandlr(22,3,long) < 14 days ago SMA(50,Close)]

and [15 days ago Chandlr(22,3,long) < 15 days ago SMA(50,Close)]

and [16 days ago Chandlr(22,3,long) < 16 days ago SMA(50,Close)]

and [17 days ago Chandlr(22,3,long) < 17 days ago SMA(50,Close)]

and [18 days ago Chandlr(22,3,long) < 18 days ago SMA(50,Close)]

I continued this test for 19 days ago, 20 days ago, etc. until about 110 days..... which is about 1/2 of a trading year. So the stock must be in a continuous downtrend for nominally 1/2 year (or more) for this scan to catch it. Many days this scan finds nothing. What it does find will have some very crappy SCTR rankings, often in single digits. It's picking a bottom in a stock that's been in a 6 month downtrend, after all.

It triggers when:

1. the average volume over 20 days of the stock is at least 100,000 shares - so no thinly traded stocks.

2. The SLOPE of the 50 day simple moving average is 0.12 or greater -- the 50 day moving average has turned at least a little positive.

3. Today's close is ABOVE the Chandelier Long line.

4. The close price is at least 55 cents.....no 6 cent penny stocks will be found.

5. The close price is less than $130 - had to cut it off somewhere.

6. And THE KEY - the Long Chandelier line CROSSES OVER the 50 day moving average.0 -

Fascinating post and scan, @WGFF . Thanks for contributing to the forum.

Some comments.

Slope is a measure of the linear regression line of closes for the period specified, not the moving average. Of course, if slope is positive, then the general direction of the MA will be positive, too, so it's a minor point. And it's probably better to test for Slope rising than MA rising, because the MA tends to be more wavy.

I think you meant to say the Slope value should be greater than .012, not 0.12. Assuming that's correct, Slope(50)>.012 did not happen on ABX until the second week of January (1/14). This was actually a better entry than the crossover in the first week.

Also, I wonder about the condition that Chandelier must not cross the 50 SMA for the 110 days prior to one day before the scan date (the test starts at 2 days ago, as you've copy/pasted it here). The ABX chart shows that Chandelier long was above the 50 MA for several days in October and November (10/27, 29, 30 and 11/2-17). Or maybe there's something I misunderstood. (On the chart, if you change the SMA to an EMA, the Chandelier does NOT cross the EMA 50 after early August - not sure if that's 110 days).

Finally, you mention that this scan caught golds and energies that advanced strongly. One test for the value of a scan is, does it catch the winners, which you report this one does, which is great. But another test is, what else does it catch? In other words, what is the ratio of winners to not so good hits, and how do you tell the difference?

Thanks again for your sharing your observations, your creativity and hard work. I appreciate it very much.

0 -

Markd - thanks for your comments. I'm brand new to the forum, and not sure I'm replying correctly.......learning as I go.

By Mid-January and into February I was buying a lot of gold and silver stocks..... those listed up above in my first response here...and some other stocks, too. A buddy gave me a newsletter recommending many of the stocks I mentioned above, and they charted well, . . . . and I bought them.

I didn't even WRITE this scan until probably late February. I had all these indicators on my charts [50 day MA / Chandelier, and a few others] and I was trying to write a scan to 'reverse engineer' a Long Entry into all of these stocks - to get a BUY signal to trigger sometime in January for all of them. If you chart all 10-12 of them, some entry point in January is pretty optimal.

By hit or miss, I came up with this scan. And I DO use the slope at 0.12 / NOT 0.012. I want to be a little more sure that my trend change has occurred. This scan is for extreme bottom fishing after all, and I don't like whipsaws, and fake entries at false bottoms. I didn't actually 'rigorously' back test it all, to be honest, so a couple of your critiques above may well be correct. Thanks for the feedback.

My real job is in the energy industry, so I take a look quite often at the charts of energy / oil / gas companies. All the ones you are thinking of are clients of the company where I work. Shell / Exxon-Mobil / Anadarko / Hess / Noble Energy / Chevron, ConocoPhillips, etc. etc. So when they are making money and increasing their stock price, I have a lot of work to do - and vice versa. Boom and bust all the way, BAYBEEE!

All through the winter and very early spring, all of these energy stocks were continuing a downtrend - actually, an extended downtrend. The oil and gas industry wasn't healthy at all. Oil prices and oil company stock prices had been dropping and dropping, all over the world, for months - over a year, even in many cases.

It dawned on me that this scan - at some point in the future, but who knew when exactly - would start to trigger BUY signals on all of these energy stocks, just as it could find good entry points for precious metal stocks in January.

As it turned out, the BUY signals started to show up on all of these stocks within about a month of my writing this scan. I've done well with these stocks, too, but they are turning downward now.

Putting the technical aside (mostly) another way to use this scan is to put the 50 period MA and the Chandelier on a WEEKLY chart. If you haven't had a BUY signal in YEARS on a weekly chart with the same criteria - well, the odds are pretty good all known buyers have left the stock/sector, etc. Everyone who EVER wanted to sell something has done it. So - FUNDAMENTALLY - there should be no one left to sell, and then only buyers are left.

Look at a weekly chart of GLD or SLV for instance. The Chandelier line hasn't been above the 50 Period MA since about 2011 or 2012. Sellers have controlled the market all that time - until early 2016. So - fundamentally - would you expect that to be a false indication of a trend change? OR likely a good buying opportunity near the market bottom? You're probably not risking much at all to take a small position, and start adding to it if the price, and the 50 period MA, and the Chandelier line keep moving up.

Look at a weekly chart of XOM / CVX / APC. The Chandelier line has been below the 50 period MA for a year and a half, prior crossing this spring. In the case of APC, it STILL hasn't crossed on a weekly chart.

What is a market that hasn't made any noise in quite some time: Biotech. I'm just waiting for this scan to start triggering on one, then two, then 5, then 10 Biotech stocks a day. It could happen soon - or it could be a year or more away. I'll catch it when the move starts, though!

Without rigorous mathematical proof, I think that's why this scan works pretty well. Fundamentally, it's not likely to trigger - especially on a Weekly Chart - until sellers have completely exhausted their efforts. Entries don't risk much - the long term recent low is your drop dead exit signal that you caught a false rally.

just my thoughts here - sharing them with the forum and you, since you asked.

0 -

I think you are basically right when you apply your thinking to resource stocks - in other words, stocks in industries that will always be around (at least for the foreseeable future) and have their ups and downs tied firmly to economic activity. I'm not sure the buy signal always comes in other areas, where business models become obsolete, so the stocks never recover, like internet or retail. Also, the recovery in other industries, like Biotech, may not be so uniform if it depends on company specific innovations. Nevertheless, I think your market sense is right on. That approach requires patience, but you seem to have plenty. I hope it keeps working for you.

0 -

Recently, I decided to scan for 120 day channel breakouts for longer term investing. In trying to figure out what made ABX such an explosive breakout, I noticed a couple of other breakouts that went along with the 120 day channel move.

There was a bollinger band breakout on the weekly timeframe, and also a Keltner chan breakout on the daily (20,2.5,20).

I don't have the means to backtest this, but I found it interesting that there were 3 different breakouts coming together.

Look at WTI, right now (Dec 19, 2016), or BREW back in June.

Of course, getting out of the move is just as important.

If someone can backtest this, I'd be interested to know the results! Let me know what you think.0 -

@isabelds I haven't noticed this particular set of circumstances, but it does seem that time has some role in when a stock takes off, so that a number of indicators will trigger at roughly the same time.

But to get at the question of how to find stocks that have the potential to take off, what they seem to have in common is a pretty long period of sideways movement after a decline long enough or sharp enough to turn down the long term MA. I use MA 251, but MA 200 is probably good, too.

I think what you want to see is no new lows for an extended period of time while the MA 251 is still falling. So you would test for the MA 251 falling, and then the Lower Price Chan(251) EQUAL to some number of months ago (expressed in days, which would be some multiple of 21, which is about a trading month, so maybe 3 or 6 months). This test would have picked up both WTI and BREW. Note it would only put them on your watch list, not signal an entry, and it would pick up hits that aren't going to take off also - things that are just pausing before they continue down.

A second common characteristic would be, in the same falling MA 251 with flat lower channel scenario, a rising lower channel 63 AND a narrowing 63 day channel - so Upper Price Chan 63 minus Lower Price Chan 63 would be less today than, say, three months ago (because the lower channel is rising faster than the upper channel is falling). This approach would get BREW, but not WTI. But it would probably eliminate more false positives.

I hope that gives you some ideas.0 -

Thank you markd. My dilemma has been: which 120 channel breakout do I choose?

The reason I decided on a 120 chan breakout is for the exact reason you highlight, no newer lows, usually lots of sideways action, minimizing a breakdown to new lows given the breakout to a new 6 month high. However, how do I choose the stock that has the greatest potential to keep going up, from the many candidates? Obviously nothing is guaranteed, but aside from volume, is there a good metric to narrow the list? It's been hit and miss with the weekly ROC(20) that I have been using, so I was looking at the weekly bollinger band, when I noticed ABX.0 -

The Wyckoff approach says that stocks make big gains after a period of accumulation, which, when it occurs, would normally happen in the ranging period. That suggests that a long term volume indicator might catch accumulation happening. Different volume indicators give different results and it's sometimes hard to figure out which is best.

In the the two examples you selected, MFI(63) seems to work pretty well. In both cases, it lifts off from the lows, and then stays relatively high while price works its way down. The divergence indicates accumulation.

Another is Force with longer parameters. On my charts I use Force 251, with MAs 21, 63 and 251. Sometimes you get a divergence similar to MFI, like BREW, where price drifts down but Force drifts up, and sometimes you get a pop and a gradual sideways move back down, but less than price, like WTI, which made a double bottom in price, but not in Force, showing net accumulation.

A second factor, besides accumulation, is relative strength. The two most important seem to a stock's RS vs the market - as represented by the Price Performance indicator using symbol:$SPX - and a stock's RS vs is own industry - symbol:$INDUSTRY. During the ranging period, both of these should be showing a general upward trend. You can clarify the trend by adding an MA21. The MA 21 should be pretty clearly rising, and the RS line itself should be above it most of the time. It doesn't have to be there - it's really not in BREW or WTI - but it should add confidence if you do see it.

I just saw that I'm repeating myself from my prior answer above. Sorry about that. I'll leave it here anyway. And I just noticed you said "apart from volume". I'm not sure why you don't want to consider that, but I hope I didn't waste your time.0 -

Interesting video in this thread RE: Wyckoff. It's a long video. I haven't watched it all

https://usethinkscript.com/threads/richard-wyckoff-accumulation-phases.979/

0

Categories

- All Categories

- 2.3K StockCharts

- 395 SharpCharts

- 146 Other Charting Tools

- 69 Saved Charts and ChartLists

- 1.5K Scanning

- 74 Data Issues

- 177 Other StockCharts Questions

- 218 Technical Analysis

- 155 Using Technical Analysis

- 2 InterMarket and International

- 19 Market and Breadth Indicators

- 42 Market Analysis

- 109 Trading

- 109 Trading Strategies

- 163 S.C.A.N the StockCharts Answer Network forum

- 65 Using this StockCharts Answer Network forum

- 98 s.c.a.n. archives

- 5 Off-Topic

- 6 The Cogitation & Rumination Emporium

- Forum Test Area